For accrual https://1investing.in/ing, you need to credit one account and debit another. If an account is increased by one account, it is decreased by the other. Revenue Recognition handles refunds and disputes by generating contra revenue to offset already recognized revenue. To add a service period or split a payment into different revenue recognition schedules. This allows you to customize revenue treatment behavior and configure rules such as payment amount, description, and customer email.

A Beginner’s Guide to Using Contra Asset Accounts – The Motley Fool

A Beginner’s Guide to Using Contra Asset Accounts.

Posted: Fri, 05 Aug 2022 07:00:00 GMT [source]

If a payroll accounting offers an early payment discount (such as 1% or 2% of the invoice amount if it is paid within 10 days instead of the required 30 days) the amount of the discount is recorded in the contra revenue account Sales Discounts. Again, the company’s management will see the original amount of sales, the sales discounts, and the resulting net sales. Although sales returns and sales allowances are technically two distinct types of transactions, they are generally recorded in the same account. Sales returns occur when customers return defective, damaged, or otherwise undesirable products to the seller.

Interest revenue

To report the real value of the financial statement, you will need to record the amount you can reasonably estimate that will probably effect the financial statement classification. Bad debt expense is an expense that a business incurs once the repayment of credit previously extended to a customer is estimated to be uncollectible. A contra account is an account used in a general ledger to reduce the value of a related account. The company should know the reasons for the increase in contra-revenue every month to save extra cost and time. Bad DebtsBad Debts can be described as unforeseen loss incurred by a business organization on account of non-fulfillment of agreed terms and conditions on account of sale of goods or services or repayment of any loan or other obligation. In the above case, the company will bear a loss margin of $100, and the contra revenue amount is $100.00.

- The accumulated depreciation amount shows how much depreciation expense has been charged against an asset.

- In other words, contra sales revenue is the difference between gross revenue and net revenue.

- The company will have to maintain separate human resources for such accounting.

- Revenue recognition treats each invoice line item as its own performance obligation.

- Sales Allowance/Rebate – If the company sells the goods and has some minor defects, then it sells such goods with some rebate/ allowance.

The Sales Discounts account shows the discounts you gave to a customer. Contra revenue accounts deduct money from your business’s sales revenue. So, you need to debit these accounts and credit the corresponding account, like Accounts Receivables. Depreciation and SG&A expenses are deducted from gross profit to find the operating margin, also known as EBIT. EBIT less interest expense is pre-tax income, and pre-tax income minus taxes is net income.

Revenue Recognition methodology

Accounting contra asset accounts or contra revenue accounts follow a simple double-accounting procedure to eliminate errors in financial reporting. The most common way to account for contra accounts is to attach the regular account with its connected contra account underneath it on a company’s balance sheet. For example, the depreciation value will be listed underneath the value of a vehicle, or the allowance of bad debts will be attached to the accounts receivable. Another example could be when a product is bought and is returned at face value because of a defect. The contra return on sales account will be debited while the normal cash account will be credited. A contra account is used to record adjustments and transactions that have an opposing impact to report the true value of a firm’s financial statements.

Contra Liability Account Definition – Investopedia

Contra Liability Account Definition.

Posted: Sun, 26 Mar 2017 04:36:36 GMT [source]

Profit shows you the amount your business gains or loses after you deduct expenses. To calculate your profit, or net income/loss, you must use your business’s revenue as a starting point. To find your profit, subtract your total expenses from your total revenue. Revenue recognition is built on top of a double-entry accounting ledger that tracks debits and credits resulting from your business activity. Balance of such accounts are under debit side, while revenue balances are under credit side.

Contra accounts serve an invaluable function in financial reporting that enhances transparency in accounting books. The sales allowance shows the discounts given to customers when returning the product. This is done to entice customers to keep products instead of returning them.

Contra Account Definition in Accounting

A general ledger is a comprehensive list of all accounts and their connected transactions in a business. A contra account balances the numbers from two or more accounts that are compared on the balance sheet. Normal accounts on the general ledger will usually have a debit balance, while contra accounts are typically either zero or hold a negative credit balance. When a contra asset account is first recorded in a journal entry, the offset is to an expense. For example, an increase in the form of a credit to allowance for doubtful accounts is also recorded as a debit to increase bad debt expense. A contra liability is an account in which activity is recorded as a debit balance is used to decrease the balance of a liability.

Inventory is updated with the debit entry and the cost of goods sold is reduced with the credit. By keeping the original dollar amount intact in the original account and reducing the figure in a separate account, the financial information is more transparent for financial reporting purposes. For example, if a piece of heavy machinery is purchased for $10,000, that $10,000 figure is maintained on the general ledger even as the asset’s depreciation is recorded separately. The amount is reported on the balance sheet in the asset section immediately below accounts receivable. The net of these two figures is typically reported on a third line. This type of account could be called the allowance for doubtful accounts or bad debt reserve.

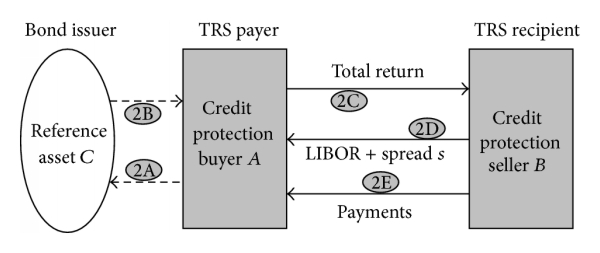

The two common contra liability accounts, discount on bonds payable and discount on notes payable, carry normal debit balances. The discount on bonds payable represents the difference between the amount of cash a company receives when issuing a bond and the value of the bond at maturity. Notes payable represents a liability created when a company signs a written agreement to borrow a specific amount of money. The lender may offer the company a discount if it repays the note early.

This allows the reader to see both the current and historical book values for a particular asset or liability. The amount on the equity contra account is deducted from the value of the total number of outstanding shares listed on a company’s balance sheet. Consider what would happen if you have sales on credit that you reasonably expect will not be paid.

Financial Statements

507XXX Other RevenuesThis major source of revenue account includes financial resources generated by the institution and which are not specifically identified elsewhere in the CHART OF ACCOUNTS. For example, you invested money into a business and earn interest on it. Revenue does not show you how much your business actually has during a period.

These other partners typically identify the opportunity as a “house” account and eliminate the expense of paying a commission to a sales rep. They pass all or part of the savings on in a lower price and win the bid. If the partner who does the work is not protected from this free-rider effect, eventually the investing partner stops doing that work and the brand company doesn’t see or doesn’t get specified into future opportunities. If these programs reduce your top-line revenue as a brand owner while increasing complexity and costs, why use them? For instance, the allowance for doubtful accounts reduces the net amount of accounts receivable, while the reserve for obsolete inventory does the same for inventory. Similarly, accrued liabilities reduce the total amount of current liabilities. A company creates allowances for doubtful accounts to record the portion of accounts receivable which it believes it will no longer be able to collect.

Sales revenue can be shown on theincome statementby either the gross revenue amount or net revenue. Gross revenue is before contra-revenue accounts like allowance for sales returns, bad debt expense, any potential sales discounts, etc. Gross revenue is reduced to net revenue after accounting for all of the previously discussed contra-revenue accounts. A regular asset account typically carries a debit balance, so a contra asset account carries a credit balance. Two common contra asset accounts include allowance for doubtful accounts and accumulated depreciation. Allowance for doubtful accounts represents the percentage of accounts receivable a company believes it cannot collect.

A contra revenue account carries a debit balance and reduces the total amount of a company’s revenue. The amount of gross revenue minus the amount recorded in the contra revenue accounts equal a company’s net revenue. A transaction is made under the sales return account when a customer returns a product to the company for a refund.

If you buy a pair of shoes from your supplier for $20, that’s a cost, but it’s not yet an expense. That’s because, as far as accounting is concerned, you haven’t really “spent” $20. You’ve just converted $20 worth of cash into $20 worth of shoes; an asset that remains in your inventory.

- Contra equity reduces the total number of outstanding shares on the balance sheet.

- Access current County policies regarding budget, investment, reserves, debt, and workers compensation.

- The allowance method of accounting allows a company to estimate what amount is reasonable to book into the contra account.

Contra accounts are used to help a company report the original amount of a transaction as well as reductions that may have happened. They serve an invaluable function in financial reporting that enhances transparency in accounting books. However, if the billing office stopped there, you would overstate your assets and net income. You must also report the amount that you can reasonably expect will not be paid, if it is estimable and probable. You could simply adjust the parent account…but then you are missing an essential part of the story — how many patients were actually treated today for a sprain.

You make sales frequently, but you might not consistently earn money from side activities. Non-operating revenue is listed after operating revenue on the income statement. Sales revenue can be shown on the income statement by either the gross revenue amount or net revenue. A contra account is an entry on the general ledger with a balance contrary to the normal balance for that categorization (i.e. asset, liability, or equity).